Getting My What Is Medigap To Work

Wiki Article

The Facts About Medigap Benefits Uncovered

Table of ContentsNot known Details About Medigap Benefits Not known Details About Medigap The Buzz on MedigapExcitement About What Is MedigapMedigap Benefits Can Be Fun For EveryoneEverything about How Does Medigap Works

A (Lock A locked lock) or implies you have actually securely linked to the. gov website. Share sensitive info just on official, safe websites.What truly stunned them was the realization that Medicare would not cover all their wellness care costs in retired life, consisting of those when traveling abroad. "We travel a whole lot and want the security of understanding we can obtain medical treatment far from residence," claims Jeff, who with Alison is looking forward to seeing her family in England.

"Talk to your medical professional concerning aging and take a look at your family background," states Feinschreiber. Considering that there is no "joint" or "household" protection under Medicare, it may be more price reliable for you as well as your spouse to choose various insurance coverage choices from separate insurance coverage companies.

5 Easy Facts About Medigap Shown

The Ottos understand that their needs may change in time, particularly as they cut itinerary as they grow older. "Although we have actually seen prices increase over the last 2 years considering that we signed up in Medigap, we have the appropriate degree of supplemental coverage for now and also assume we're obtaining excellent worth at $800+ each month for the both of us including dental coverage," stated Alison.For locals in choose states, sign up in the right Medicare prepare for you with assistance from Fidelity Medicare Solutions.

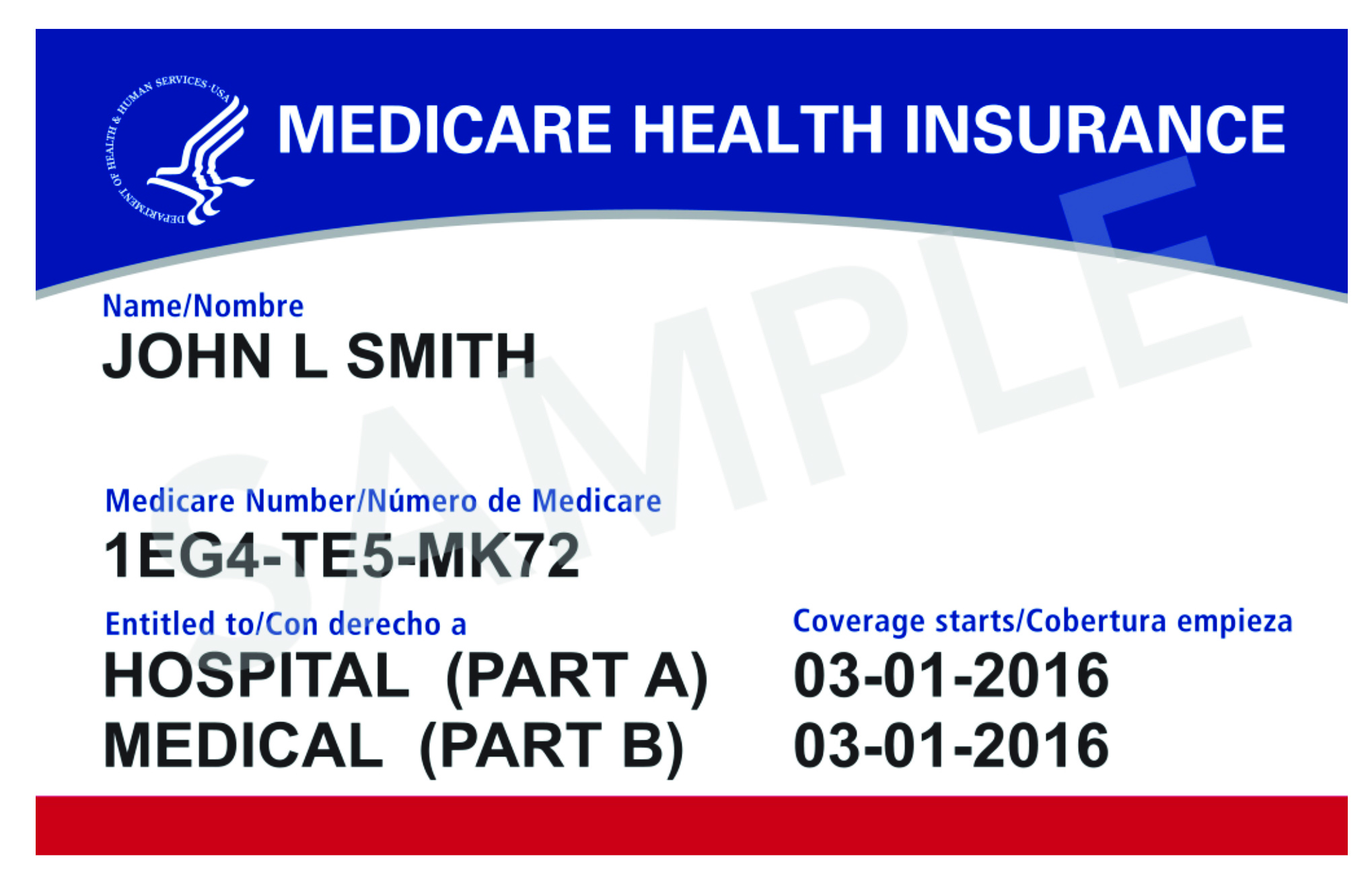

Not every strategy will certainly be available in every state. Medicare Supplement Insurance coverage is offered by exclusive insurer, so the expense of a plan can differ between one service provider or area as well as one more. There are a couple of various other points that may affect the cost of a Medigap strategy: The amount of coverage offered by the strategy Whether or not medical underwriting is made use of as component of the application process The age at which you sign up with the strategy Eligibility for any kind of discounts supplied by the carrier Sex (ladies commonly pay less for a plan than males) In order to be eligible for a Medicare Supplement Insurance strategy, you need to be at the very least 65 years old, enrolled in Medicare Component An and Component B and also live in the area that is serviced by the strategy.

The Facts About How Does Medigap Works Uncovered

You are enrolled in a Medicare Advantage or Medigap strategy provided by a company that deceived you or was found to have not followed specific regulative policies. Medicare Supplement strategies and also Medicare Benefit plans work extremely differently, and you can't have both at the same time. Medicare Supplement prepares work alongside your Initial Medicare coverage to help cover out-of-pocket Medicare costs like deductibles as well as coinsurance.Numerous strategies also provide various other benefits such as prescription drug coverage or oral care, which Original Medicare doesn't usually cover. Medicare Supplement plan costs can vary based on where you live, the insurance provider using plans, the rates framework those companies make use of as well as the kind of plan you make an application for.

The average month-to-month costs for the same strategy in Iowa in 2022 was only $120 each month. 1 With 10 different kinds of standard Medigap plans and also a range of advantages they can provide (as well as the variety of month-to-month costs for each plan), it can be valuable to take the time to contrast the Medigap options readily available where you live - Medigap benefits.

The Best Strategy To Use For What Is Medigap

You need to take into consideration changing Medigap plans during certain times of the year, nevertheless. Transforming Medicare Supplement prepares during the correct time can assist this contact form secure you from having to pay greater premiums or being denied insurance coverage as a result of your health and wellness or preexisting problems. There are a variety of different Medicare Supplement Insurance firms throughout the country.

You can discover more concerning them by contrasting business scores and reading customer reviews. Medigap Strategy F covers extra out-of-pocket Medicare expenses than any type of other standard kind of Medigap plan. For their regular monthly premium, Strategy F recipients understand that all of their Medicare deductibles, coinsurance, copays and also various other out-of-pocket costs will certainly be covered.

com that educate Medicare recipients the most effective practices for navigating Medicare (What is Medigap). pop over to this web-site His short articles read by hundreds of older Americans monthly. By better recognizing their health and wellness care insurance coverage, visitors might ideally learn just how to limit their out-of-pocket Medicare investing as well as access high quality healthcare. Christian's interest for his function stems from his need to make a difference in the senior area.

The 20-Second Trick For What Is Medigap

During that time structure, insurance provider are normally not allowed to ask you any wellness concerns (also recognized as clinical underwriting). After that, you might need to respond to those questions, and also the responses might lead to a greater costs or to being declined for Medigap insurance coverage. A couple of exceptions exist.This is real only if they drop their Medicare Advantage protection within 12 months of signing up. Keep in mind: If you as well as your partner both get Medigap policies, some insurance policy providers will certainly provide a household price cut. That depends upon the plan you pick. Medigap has 10 standardized insurance coverage plans that are recognized with letters of the alphabet: Plans A, B, C, D, F, G, K, L, M and also N.

Nevertheless, within each plan, the advantages are home the same since they are standardized. A Strategy A plan will have the exact same advantages no issue what insurance business you acquire it from. So, the secret is to determine which strategy offers advantages that are crucial to you. You can contrast deals from insurance firm to insurance firm to locate the most inexpensive cost for the plan you want.

Report this wiki page